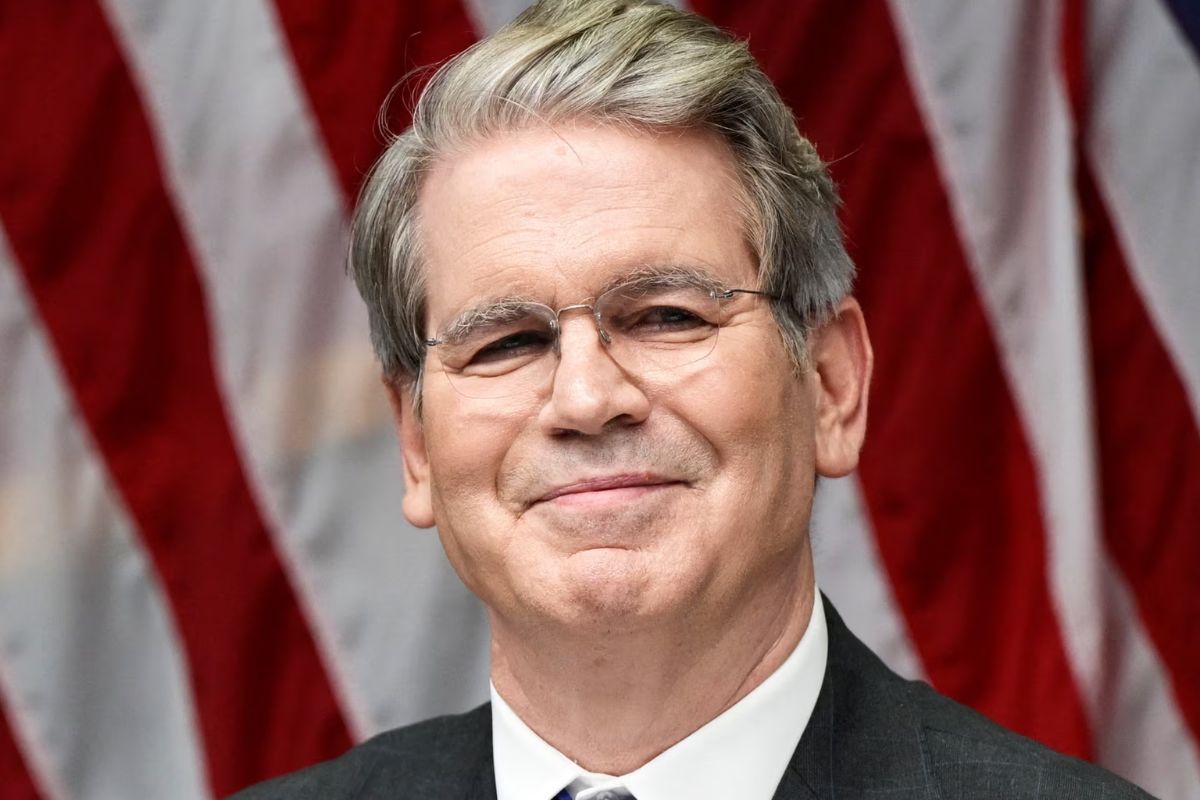

In a dramatic escalation of U.S. China tensions, Treasury Secretary Scott Bessent has warned that China’s continued purchases of Russian oil could face 100% tariffs, as the U.S. pushes a hardline stance on enforcing sanctions against Moscow. Speaking after high-level trade negotiations in Stockholm, Bessent cited pending legislation that would impose secondary tariffs on nations and companies that support Russia’s energy sector, describing it as a “direct threat to global sanctions integrity”.

According to U.S. officials, China currently imports over 2 million barrels of Russian oil daily roughly half of Moscow’s seaborne exports and continues to trade in sanctioned Iranian crude. Washington also flagged China’s role in exporting more than $15 billion in dual-use goods to Russia, aiding its war effort in Ukraine.

Bessent warned that if China does not curb these activities, it could trigger the “most aggressive tariff measures ever applied,” with rates potentially exceeding 500%. Chinese negotiators responded by defending their right to energy sovereignty, signaling no immediate policy shift despite U.S. pressure.

Trade Truce Extension in Limbo as Trump Holds Final Say

The Stockholm trade talks, held over two days, concluded without resolution on key U.S. China disputes. Although negotiators agreed in principle to extend the current tariff pause, U.S. officials emphasized that President Trump has the final say. Bessent described the talks as “robust and constructive,” but reiterated that Beijing’s premature announcement of an extension was “overconfident”.

During an interview with CNBC, Bessent suggested that the reimposition of tariffs wouldn’t be “the end of the world,” especially if negotiations continue in good faith. He added that Trump is prepared to let tariffs kick back in on August 1 if satisfactory concessions aren’t made.

Trump’s administration has set a 10–12 day ultimatum for progress on ending Russia’s war in Ukraine, threatening not only U.S. tariffs but coordinated penalties from G7 and EU allies. According to Bessent, “The pressure is building, and the window for diplomacy is rapidly closing.”

Global Energy and Trade Markets Brace for Fallout

The geopolitical standoff has already begun to reverberate across global markets. Oil prices, which surged more than 3% earlier in the week, held steady on Tuesday as investors weighed the risk of sanctions-induced supply shocks. Brent crude hovered around $72.65, while WTI traded at $69.20.

Analysts warn that a full-scale tariff enforcement could cut Russian oil exports by over 2 million barrels per day, especially if India and Turkey follow the U.S. lead. China’s refusal to scale back imports could put it at the center of a new global economic flashpoint.

Meanwhile, the U.S. and EU reached a partial trade agreement, signaling hopes of avoiding a broader conflict on other fronts. The IMF recently revised its global growth forecast to 3%, but cited renewed trade tensions as a key downside risk moving into Q4.

As the deadline nears and U.S. rhetoric intensifies, the world watches closely aware that this showdown could reshape not only the future of U.S. China relations but the global energy order itself.

Explore More News In Our Oil Gas Energy Magazin

Source: