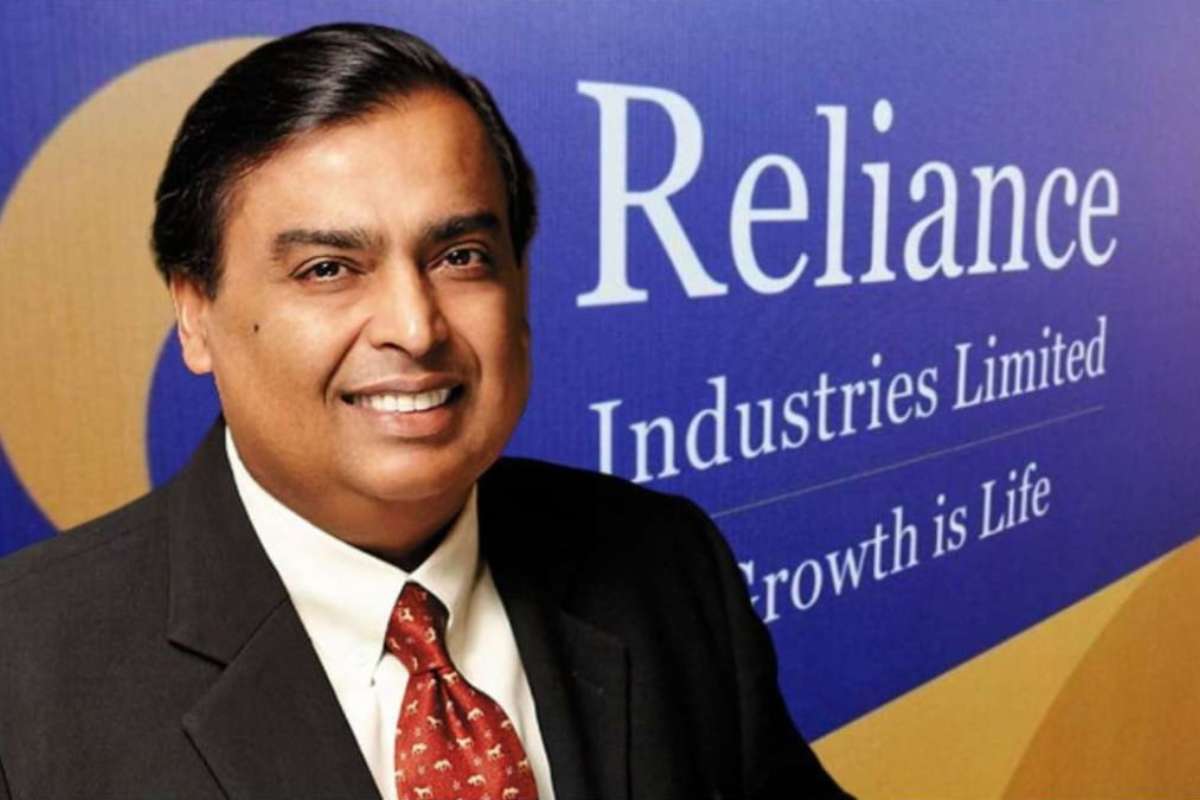

In a landmark agreement, Russia’s state-owned oil giant Rosneft has signed its largest-ever crude supply deal with India’s private refiner, Reliance Industries. The deal, spanning 10 years, involves the supply of approximately 500,000 barrels per day (bpd) of crude oil, accounting for nearly 0.5% of the global supply. At current prices, this agreement is valued at around $13 billion annually. The deal comes at a time when Western sanctions on Russia, stemming from its 2022 invasion of Ukraine, have redirected global energy trade flows.

The agreement highlights India’s growing role as a critical buyer of Russian oil amid sanctions. As the European Union reduced Russian imports, India seized the opportunity to purchase oil at discounted prices. Russia now accounts for over a third of India’s total energy imports, making it a significant player in India’s energy security strategy. This deal strengthens bilateral energy cooperation ahead of Russian President Vladimir Putin’s planned visit to India.

Competitive Edge and Market Dynamics

The Reliance and Rosneft deal poses a challenge for competing oil producers, particularly those in the Middle East, like Saudi Arabia. India is one of the fastest-growing energy markets, with increasing demand positioning it as a key player in global energy consumption. With slowing growth in China, oil producers are fiercely competing for market share in India.

Under the agreement, Rosneft will supply Reliance with 20-21 Aframax-sized shipments of Russian crude monthly, along with three cargoes of fuel oil. These deliveries will be directed to Reliance’s Jamnagar refining complex in Gujarat, the largest refining hub in the world. The deal’s terms allow for annual reviews of pricing and volumes to reflect changes in global market dynamics.

Reliance and Rosneft had previously collaborated on smaller crude supply deals, but this agreement marks a substantial increase in volumes. It is expected to absorb nearly half of Rosneft’s seaborne oil exports, significantly limiting supplies available for intermediaries and other buyers.

Oil Pricing and Future Prospects

Sources familiar with the agreement revealed that pricing will be linked to the Dubai benchmark, with slight premiums for specific Russian light sweet crude grades like ESPO, Sokol, and Siberian Light. Meanwhile, the medium-sulphur Urals crude, which is particularly favored by Indian refiners, will be priced at a discount of $3 per barrel to Dubai quotes.

This long-term deal, set to begin in January 2024, could extend for another decade, underlining the strategic importance of the India-Russia energy partnership. Reliance’s imports of Russian crude have already surged, averaging 405,000 bpd between January and October 2023, up from 388,500 bpd during the same period last year.

With this agreement, Reliance further cements its position as a leading buyer of Russian oil, ensuring a steady and cost-effective supply. For Rosneft, this deal secures a long-term buyer at a time when Western sanctions have restricted access to key markets. As global energy dynamics evolve, this partnership underscores how geopolitical shifts are reshaping the flow of oil trade across the world.